How to Build a P2P Payment App Like Venmo?

March 18,

10:35 AM

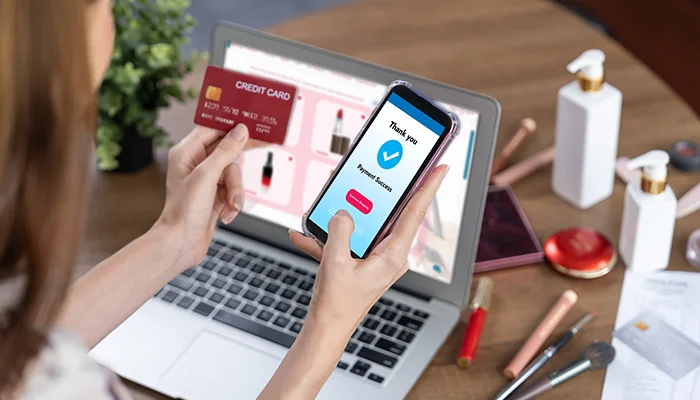

Peer-to-peer (P2P) payment apps have revolutionized the way people transfer money, making transactions seamless, instant, and secure. Among the top players in the P2P payment industry, Venmo stands out for its ease of use and social payment features. If you're looking to build a P2P payment app like Venmo, this guide will walk you through the essential steps, features, and considerations to create a successful P2P payment app.

Understanding P2P Payment Apps

A P2P payment app allows users to transfer money to others directly using their bank accounts, credit/debit cards, or digital wallets. These apps eliminate the need for physical cash or checks and enable seamless money transfers between individuals and businesses.

Key Features of an App Like Venmo

When developing a Venmo-like app, incorporating essential features ensures a smooth user experience. Here are the core Venmo features you should include:

1. User Registration and Authentication: To set up a P2P payment account, users must register with their phone number, email, or social media. Secure authentication methods like two-factor authentication (2FA) and biometric login (Face ID, fingerprint) enhance security.

2. Bank Account and Card Integration: A P2P payment app should allow users to link their bank accounts, credit/debit cards, and digital wallets. This feature enables seamless fund transfers.

3. Instant Money Transfers: The core functionality of a P2P payment app is instant fund transfers between users. The app should support real-time payments or provide an option for standard bank transfers.

4. Social Media Integration: One of the standout Venmo features is its social aspect. Users can add descriptions, emojis, or messages to their transactions and interact with each other’s payments through likes and comments.

5. Security and Fraud Protection: Security is a top priority when developing a payment app. Implement encryption protocols, AI-powered fraud detection, and transaction alerts to safeguard users’ financial data.

6. Transaction History and Notifications: Users should have access to a detailed transaction history and receive real-time notifications for every payment sent or received.

7. QR Code Payments: A fast and convenient way to transfer money is through QR codes. Users can scan a code to send or request payments instantly.

8. Split Payments and Bill Sharing: A P2P payment app should allow users to split bills and expenses among multiple people. This is particularly useful for dining, rent, or travel costs.

9. In-App Wallet: Like Venmo, your app should include an in-app wallet that stores funds until users choose to transfer them to their bank accounts.

10. AI-Powered Customer Support: Offering AI-based chatbots and human customer support ensures users get quick assistance for any payment-related issues.

Steps to Build a P2P Payment App

Step 1: Market Research and Competitor Analysis

Before you start the P2P payment app development process, conduct thorough research on industry trends and analyze competitors like Venmo, PayPal, and Cash App. Identify gaps in the market and opportunities for innovation.

Step 2: Define Your App’s Unique Value Proposition (UVP)

To build a P2P payment app, you need a UVP that sets your app apart from existing Venmo-like apps. Whether it's lower transaction fees, enhanced security, or additional financial services, a clear UVP is essential.

Step 3: Choose the Right Technology Stack

Selecting the right tech stack is crucial for payment app development. Here are some recommended technologies:

- Frontend: React Native, Flutter, Swift (iOS), Kotlin (Android)

- Backend: Node.js, Python (Django), Ruby on Rails

- Database: PostgreSQL, MongoDB, Firebase

- Cloud Services: AWS, Google Cloud, Microsoft Azure

- Payment Gateways: Stripe, PayPal, Braintree

Step 4: Partner with a Reliable App Development Company

Hiring an experienced app development company like PerfectionGeeks Technologies ensures your app is built efficiently and securely. With expertise in online payment transfer app development, PerfectionGeeks provides end-to-end solutions tailored to your needs.

Step 5: Obtain Legal and Regulatory Compliance

Since your app will handle financial transactions, compliance with regulations like PCI-DSS, GDPR, and AML (Anti-Money Laundering) laws is mandatory. Work with legal experts to ensure your app meets all compliance requirements.

Step 6: Integrate Secure Payment Processing

To build a payment app, you must integrate secure payment gateways that support various transaction methods, including credit cards, debit cards, bank transfers, and digital wallets.

Step 7: Develop and Test the App

After designing the app, start with development in small iterations (Agile methodology) to ensure a smooth process. Conduct extensive testing to identify bugs and improve user experience. Testing should cover:

- Security testing

- Load testing

- UI/UX testing

- Payment gateway testing

Step 8: Launch and Market Your P2P App

Once development is complete, launch your P2P app on App Store and Google Play. To attract users, implement an effective marketing strategy that includes:

- Social media advertising

- Influencer partnerships

- Referral programs

- SEO for "how to build a P2P payment app" and related searches

Cost to Build a P2P Payment App

The cost of P2P payment app development depends on various factors, including:

App complexity – Basic vs. advanced features

Platform – iOS, Android, or both

Development team – In-house vs. outsourcing

Security & compliance – Level of data protection

Third-party integrations – Payment gateways, AI, analytics

On average, the cost to build a P2P payment app like Venmo ranges from $50,000 to $200,000, depending on app features and complexity.

Why Choose PerfectionGeeks for Your P2P Payment App Development?

PerfectionGeeks Technologies is a leading app development company specializing in P2P payment app development. Here’s why they stand out:

Expertise in secure payment solutions

Custom development tailored to business needs

End-to-end support from ideation to deployment

Cutting-edge technologies for enhanced security

By partnering with PerfectionGeeks Technologies, you can build a secure, scalable, and user-friendly Venmo-like app that meets the evolving demands of digital payments.

Conclusion

Developing a P2P payment app like Venmo requires careful planning, the right technology stack, and an experienced app development company. By incorporating essential Venmo features, ensuring compliance, and prioritizing security, you can create a P2P app that offers seamless money transfers. If you're ready to build a P2P payment app, PerfectionGeeks Technologies is your go-to partner for innovative payment app development solutions.

Blockchain Solution

Launching

- Market Research & Analysis

- Strategic Planning

- Branding

- Content Creation

- Social Media Marketing

- Analytics and Reporting

Testing

- Unit Testing

- Integration Testing

- Smoke Testing

- Security Testing

- Recovery Testing

- System Testing

- Regression Testing

- Performance and Load Testing

- UAT User Acceptance Testing

Maintenance

- Security Updates

- Performance Optimization

- Database Management

- Monitoring & Reporting End-of-Life Planning

Contact US!

Copyright © 2025 PerfectionGeeks Technologies | All Rights Reserved | Policy

Contact US!

India

Plot 378-379, Udyog Vihar Phase 4 Rd, near nokia building, Electronic City, Sector 19, Gurugram, Haryana 122015

Copyright © 2025 PerfectionGeeks Technologies | All Rights Reserved | Policy